In the competitive world of SaaS (Software as a Service), understanding and optimizing Customer Lifetime Value (CLV) is crucial. But what exactly is CLV, and why is it so important for SaaS businesses? Let’s dive into the concept and uncover its significance.

Understanding Customer Lifetime Value (CLV)

Definition of CLV

Customer Lifetime Value (CLV) is a metric that estimates the total revenue a business can expect from a single customer account over the entire duration of their relationship. This includes all purchases and subscriptions, minus the costs associated with acquiring and serving that customer.

How CLV is Calculated

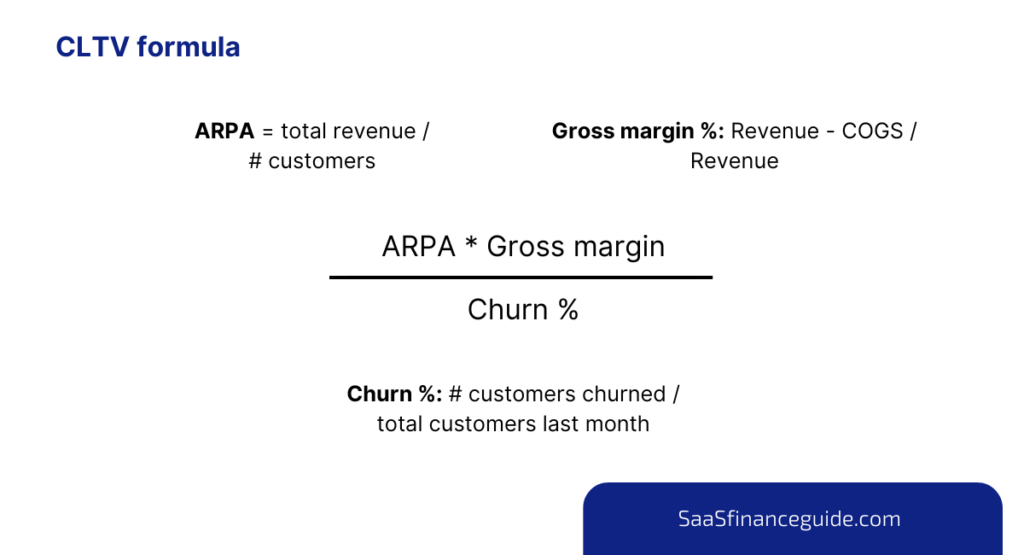

Calculating CLV can be complex, involving multiple variables. The basic formula is:

Components of CLV

- ARPA: The average amount per account

- Gross margen: Revenue – COGS

- Churn %: The average duration a customer remains active.

Why CLV Matters in SaaS

Revenue Prediction

CLV helps in predicting future revenue streams by understanding how much revenue each customer will generate over time. This allows for more accurate financial forecasting.

Customer Retention

Knowing your CLV helps in identifying which customers are the most valuable and worth investing in for retention strategies. It also highlights the importance of customer loyalty programs.

Marketing Efficiency

By focusing marketing efforts on acquiring high-CLV customers, businesses can achieve better returns on investment (ROI) for their marketing spend.

Calculating CLV for SaaS Businesses

Step-by-Step CLV Calculation

- Determine the Average Revenue Per User (ARPU): Calculate the total revenue divided by the number of users.

- Calculate the Customer Lifespan: Estimate the average time a customer continues to use the service.

- Compute the Gross Margin: Subtract the cost of goods sold from total revenue, then divide by total revenue.

- Calculate CLV: Use the formula provided earlier to determine the CLV.

Tools and Software for CLV Calculation

There are several tools available to help SaaS businesses calculate CLV, including:

- Baremetrics

- ChartMogul

- ProfitWell

Factors Influencing CLV in SaaS

Customer Churn Rate

A high churn rate negatively impacts CLV. Reducing churn through improved customer satisfaction and engagement is key to increasing CLV.

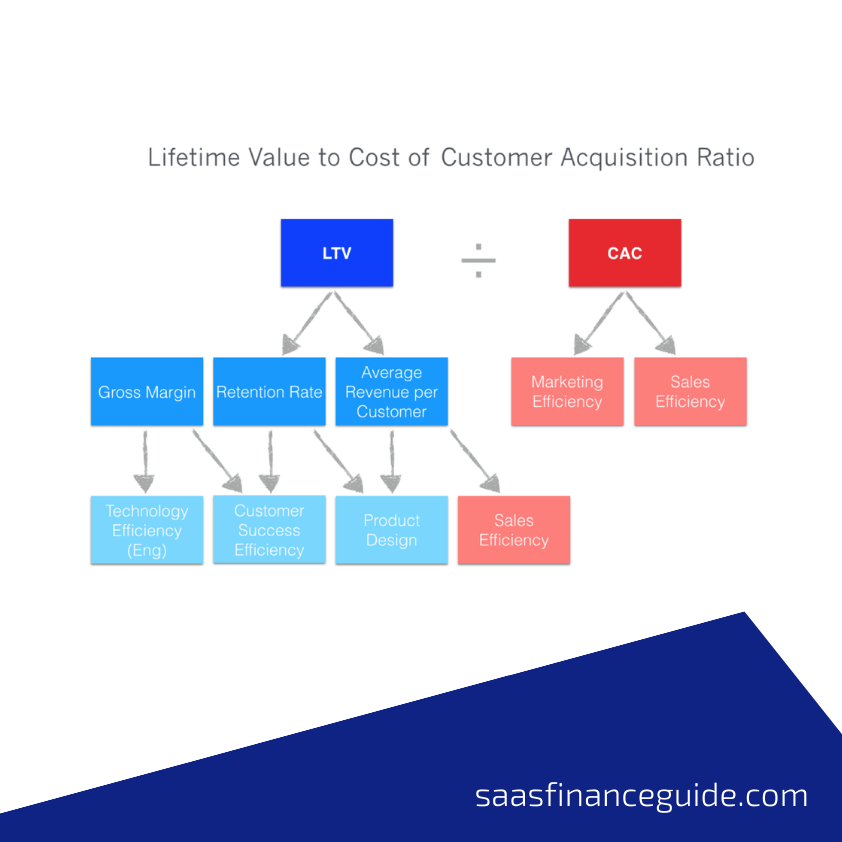

Customer Acquisition Cost (CAC)

Lowering CAC while maintaining or increasing customer value boosts CLV. Efficient marketing and sales strategies are essential here.

Average Revenue Per User (ARPU)

Increasing ARPU through upselling, cross-selling, and offering premium features can significantly enhance CLV.

Customer Engagement and Usage

Higher engagement typically leads to longer customer lifespans and higher CLV. Regularly updating features and maintaining a user-friendly interface can help achieve this.

Strategies to Improve CLV in SaaS

Enhancing Customer Onboarding

A seamless onboarding process can reduce early churn and set a positive tone for the customer’s journey.

Providing Excellent Customer Support

Responsive and helpful customer support can turn a dissatisfied customer into a loyal one, thereby increasing CLV.

Implementing Customer Feedback

Listening to and acting on customer feedback shows that you value their opinions, which can enhance customer satisfaction and loyalty.

Upselling and Cross-selling

Encouraging customers to purchase additional features or services can increase their overall spend, thereby boosting CLV.

Using CLV to Drive Business Decisions

Tailoring Marketing Campaigns

By targeting high-CLV customers, marketing campaigns can be more effective and yield higher returns.

Prioritizing Product Development

Focusing on features and improvements that are valued by high-CLV customers can lead to better product-market fit and increased customer satisfaction.

Optimizing Customer Service

Providing personalized and high-quality customer service can enhance the customer experience and reduce churn.

Case Studies: Successful CLV Implementation in SaaS

Case Study 1: HubSpot

HubSpot implemented a data-driven approach to identify high-CLV customers and tailored their marketing and support efforts to retain these customers, significantly boosting their overall CLV.

Case Study 2: Salesforce

Salesforce used predictive analytics to understand the factors influencing CLV and implemented strategies to improve customer retention and engagement, leading to higher CLV.

Challenges in Measuring and Maximizing CLV

Data Accuracy

Accurate data is crucial for calculating CLV. Inaccurate data can lead to misleading conclusions and poor business decisions.

Integrating CLV into Business Strategy

Successfully integrating CLV into the overall business strategy requires a deep understanding of the metric and its implications for different business functions.

Future Trends in CLV for SaaS

AI and Machine Learning

AI and machine learning are becoming increasingly important in predicting CLV and personalizing customer interactions to maximize value.

Predictive Analytics

Using predictive analytics to forecast CLV can help businesses make proactive decisions to enhance customer retention and revenue.

Conclusion

Understanding and optimizing Customer Lifetime Value (CLV) is essential for SaaS businesses aiming to thrive in a competitive market. By focusing on the right strategies and continuously measuring and improving CLV, companies can ensure long-term success and growth.

FAQs

What is a good CLV for SaaS?

A good CLV for SaaS varies depending on the industry and business model. However, a CLV to CAC ratio of 3:1 is generally considered healthy.

How can small SaaS companies improve their CLV?

Small SaaS companies can improve their CLV by enhancing customer support, reducing churn, and focusing on upselling and cross-selling opportunities.

What role does customer feedback play in CLV?

Customer feedback is crucial for identifying areas of improvement, enhancing customer satisfaction, and increasing CLV.

Can CLV be negative?

CLV can be negative if the cost of acquiring and serving a customer exceeds the revenue generated from that customer.

How often should CLV be calculated?

CLV should be calculated regularly, ideally quarterly or bi-annually, to ensure that strategies are effectively enhancing customer value.