Introduction

In the world of Software as a Service (SaaS), keeping a close eye on financial health is crucial. This is where a Profit and Loss (P&L) statement comes into play. A P&L statement, also known as an income statement, provides a summary of a company’s revenues, costs, and expenses during a specific period. For SaaS businesses, having a well-structured P&L template is vital for accurate accounting and informed decision-making.

Download our SaaS P&L spreadsheet template

What is a P&L Statement?

Overview

A Profit and Loss (P&L) statement is a financial report that summarizes the revenues, costs, and expenses incurred during a specific period, usually a fiscal quarter or year. It shows the ability of a company to generate profit by increasing revenue, reducing costs, or both.

Components of a P&L Statement

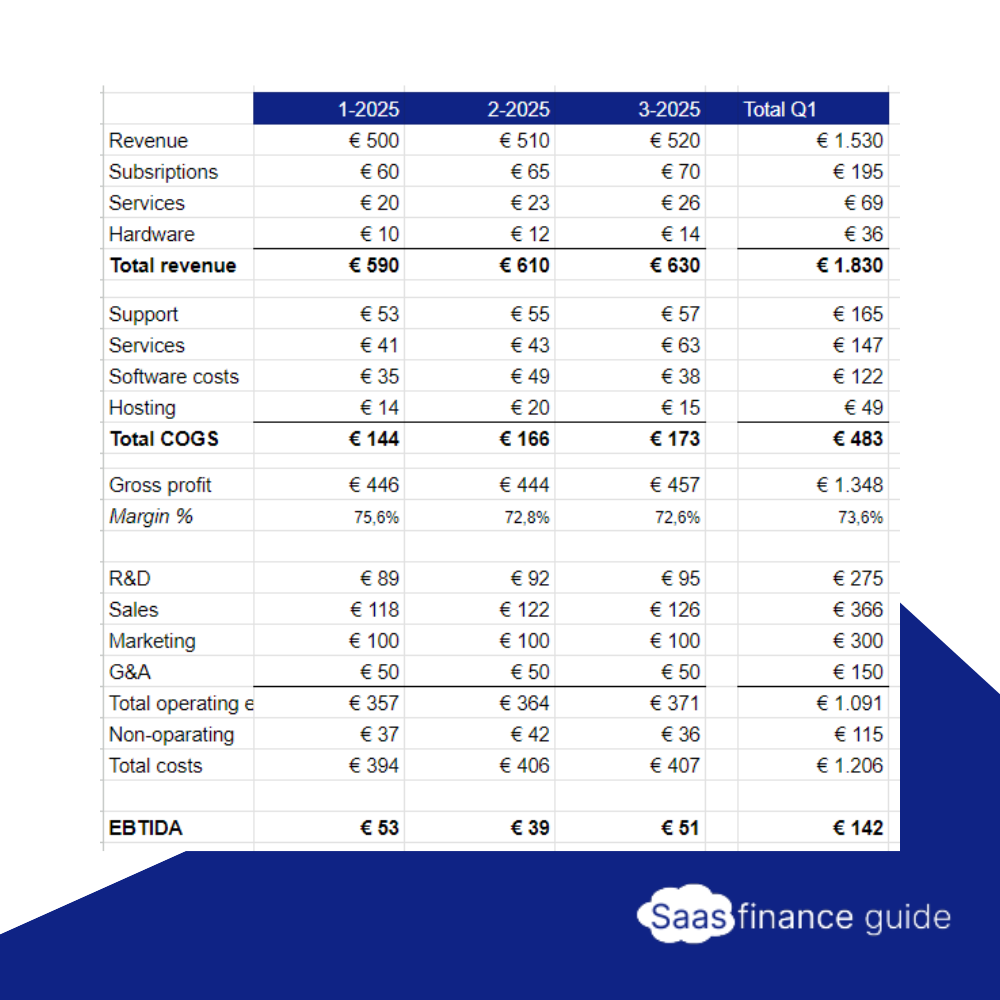

- Revenue: Total income generated from sales of goods or services.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of the goods sold by a company.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs required to run the business, such as rent, utilities, and salaries.

- Net Profit: Gross profit minus operating expenses.

Unique Aspects of SaaS Accounting

Recurring Revenue Model

SaaS businesses often operate on a subscription basis, generating recurring revenue. This model impacts how revenue is recognized and requires careful tracking of monthly recurring revenue (MRR) and annual recurring revenue (ARR).

Customer Acquisition Costs

The cost to acquire a customer (CAC) is a critical metric in SaaS accounting. It includes all costs related to acquiring new customers, such as marketing and sales expenses.

Customer Lifetime Value

Customer Lifetime Value (CLTV) is the total revenue expected from a customer over their entire relationship with the business. It’s essential for understanding the long-term value of each customer.

Why You Need a SaaS P&L Template

Simplifying Financial Management

A SaaS P&L template helps simplify the complex financial management process by providing a clear structure for tracking income and expenses.

Accurate Financial Reporting

Using a standardized template ensures consistency and accuracy in financial reporting, which is crucial for stakeholders and regulatory compliance.

Informed Decision Making

A detailed P&L statement allows SaaS businesses to make informed decisions based on their financial performance, helping to identify growth opportunities and areas for improvement.

Components of a SaaS P&L Template

Revenue

- Subscription Revenue: Income from subscription-based services.

- Service Revenue: Income from additional services offered, such as consulting or support.

Costs

- Cost of Goods Sold (COGS): Direct costs related to delivering the SaaS product.

- Operating Expenses:

- Marketing and Sales: Costs associated with promoting and selling the product.

- Research and Development: Expenses related to developing new features or products.

- General and Administrative: Overhead costs such as rent, utilities, and administrative salaries.

Creating a SaaS P&L Template Spreadsheet

Choosing the Right Software

Popular spreadsheet software like Microsoft Excel, Google Sheets, and specialized accounting tools can be used to create a SaaS P&L template.

Essential Columns and Rows

- Columns: Date, Description, Amount, Category (Revenue, COGS, Operating Expenses)

- Rows: Individual entries for each revenue and expense item

Step-by-Step Guide to Building a SaaS P&L Template

Setting Up the Spreadsheet

- Open your chosen spreadsheet software.

- Create columns for Date, Description, Amount, and Category.

- Label rows for each month or reporting period.

Inputting Revenue Data

- Enter subscription revenue and service revenue for each period.

- Sum the total revenue.

Inputting Expense Data

- Record all COGS and operating expenses.

- Sum the total expenses.

Calculating Gross Margin

Subtract COGS from total revenue to find the gross margin.

Adding Operating Expenses

List all operating expenses and subtract them from the gross margin to calculate the net profit.

Finalizing the P&L Statement

Review the data for accuracy and ensure all entries are correctly categorized.

Automating Your SaaS P&L Spreadsheet

Benefits of Automation

Automation reduces manual data entry, minimizes errors, and saves time, allowing for real-time updates and insights.

Tools for Automation

Tools like Zapier, QuickBooks, and Xero can automate data entry and financial reporting, integrating directly with your SaaS P&L template.

Analyzing Your SaaS P&L Statement

Key Metrics to Track

- Monthly Recurring Revenue (MRR)

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (CLTV)

- Churn Rate

Interpreting the Data

Analyze trends in revenue and expenses to identify growth opportunities and cost-saving measures.

Identifying Trends

Look for patterns in financial performance over time to make strategic decisions.

Common Mistakes to Avoid

Overlooking Indirect Costs

Ensure all indirect costs, such as administrative expenses, are accounted for to avoid underestimating total expenses.

Ignoring Cash Flow

Cash flow management is crucial; ensure your P&L template includes cash flow projections.

Misclassifying Expenses

Accurately classify expenses to maintain the integrity of your financial reports.

Best Practices for SaaS P&L Management

Regular Updates

Update your P&L statement regularly to keep track of financial performance in real time.

Consistent Categorization

Maintain consistency in categorizing revenue and expenses to ensure accurate reporting.

Scenario Planning

Use your P&L template for scenario planning to anticipate potential financial outcomes and make proactive decisions.

Advanced Tips for SaaS Accounting

Incorporating Deferred Revenue

Recognize revenue only when it is earned, not when cash is received, to comply with accounting standards.

Allocating Customer Acquisition Costs

Spread CAC over the customer’s lifetime to match expenses with the revenue they generate.

Forecasting Future Revenue

Use historical data to predict future revenue, adjusting for trends and market conditions.

Case Studies

Successful SaaS P&L Management Examples

Explore case studies of successful SaaS companies to learn from their financial management strategies and best practices.

Tools and Resources

Recommended Software

- QuickBooks

- Xero

- FreshBooks

Online Resources and Templates

- Templates from accounting software websites

- Financial management blogs and forums

Conclusion

Managing a SaaS business’s finances can be challenging, but a well-structured P&L template can simplify the process. By accurately tracking revenue and expenses, SaaS businesses can make informed decisions, optimize their financial performance, and achieve long-term success.

FAQs

What is a SaaS P&L template?

A SaaS P&L template is a pre-designed spreadsheet that helps SaaS businesses track their revenues, costs, and expenses, providing a clear picture of financial performance.

How often should I update my P&L statement?

It’s best to update your P&L statement monthly to keep a close eye on your financial health and make timely decisions.

Can I use a general P&L template for my SaaS business?

While you can use a general P&L template, a SaaS-specific template is recommended as it caters to the unique aspects of SaaS accounting, like recurring revenue and customer acquisition costs.

What are the biggest challenges in SaaS accounting?

The biggest challenges include tracking recurring revenue, managing customer acquisition costs, and accurately forecasting future revenue.

How can I improve the accuracy of my SaaS P&L statement?

Regular updates, consistent categorization, and the use of automation tools can greatly enhance the accuracy of your SaaS P&L statement.